RetailLawBCLP

Managing Counter-Party Risk in the Pandemic - Part 1

Getting on the Same Page

May 13, 2020Globally, boards and management teams are taking stock of current operations and finances to identity vulnerabilities to the unprecedented distress that markets are anticipating from the pandemic for the next 12-18 months. As part of those discussions, many retail businesses (and those with operations related to retail, like landlords, logistic companies, shipping interests, etc.) are focusing on receivables and risk weighting as to the collectability and the follow-on impact of doubtful accounts.

These conversations will inevitably lead to the age-old conflict that pins finance and legal functions - that are largely focused on risk – against business/sales functions, which are generally focused on sales and keeping customers happy. Pre-pandemic, sales teams historically had a leg up as revenue generation inevitably trumped risk mitigation in the context of strategic decisions. However, the same behavior and cultures that have been allowed to prevail when there was only a handful of distressed counter-parties cannot persist where companies are now dealing with entire portfolios of customers and vendors in varying degrees of stress and distress.

To be effective with mitigation, it means that Finance, Legal and Sales need to quickly get on the same page in terms of identifying the level of risk each counterparty poses to the business (and how that counterparty’s inability to pay or deliver goods/services will impact the overall business). In doing so, companies will be better able to allocate scarce resources to counterparties that pose the greatest degree of near-term risk while carefully watching future performance through the same filtered lens. Thus, before the appropriate controls and measures can be implemented, an important first step is getting the risk avoiders (finance and legal) and sales (sellers and pleasers) on the same page in terms of where certain counter-parties fall on the risk spectrum.

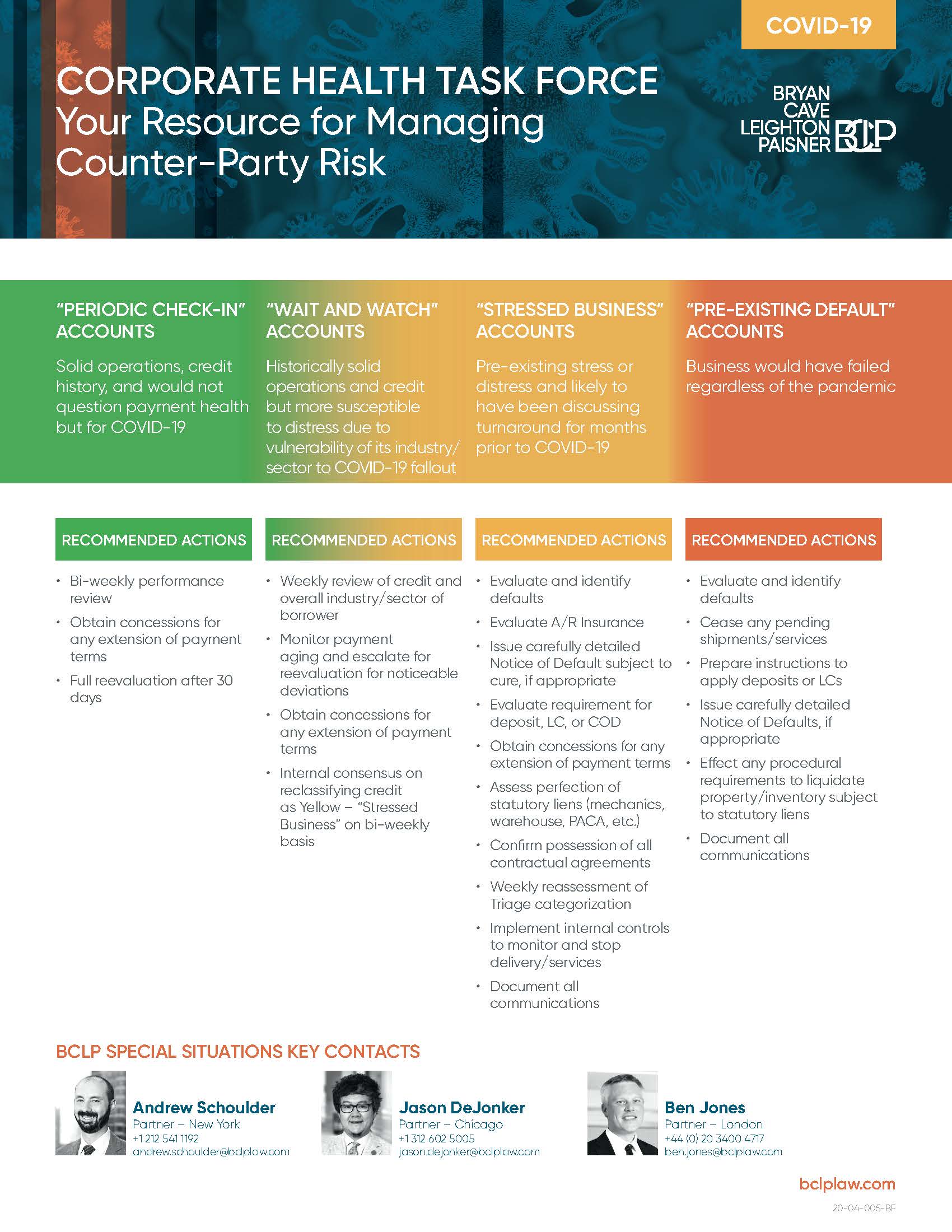

To aid you on this first step, in this Part I of Managing Counter-Party Risk, we have provided our Heat Grid for Triaging Counter-Party Risk that can serve as your one-page resource. In Part II, we will discuss considerations and measures to implement with respect to customers (including whether and when you should ship goods to customers facing financial distress), while in Part III will discuss suppliers.

View full version of our Heat Grid for Triaging Counter-Party Risk here.

Related Practice Areas

-

Retail & Consumer Products